More banking than ever is taking place on the mobile phone. This is logical given that mobile devices have become the primary communication technology for the majority of the world. The big question now is: Where will the next stage of mobility take us?

Expanding beyond mobile phones to include other mobile devices that move with our presence is in our future. These interactions are already changing mobile banking experiences in our houses, our cars, and with our watches. For financial institutions, it will be important to not focus entirely on smartphone banking, but to reimagine how banking can be done between people and the environment around them as they move through physical spaces.

This requires looking at the technologies that make mobile engagement possible and non-smartphone forms of mobile engagement. The technology can be as simple as barcodes and RFID tags, or more expansive technologies like voice, the internet of things (IOT), augmented reality (AR) and, potentially, virtual reality. With regard to alternative devices, this can include wearables that share data with existing smartphones or entirely autonomous devices like smart glasses or embedded microchips.

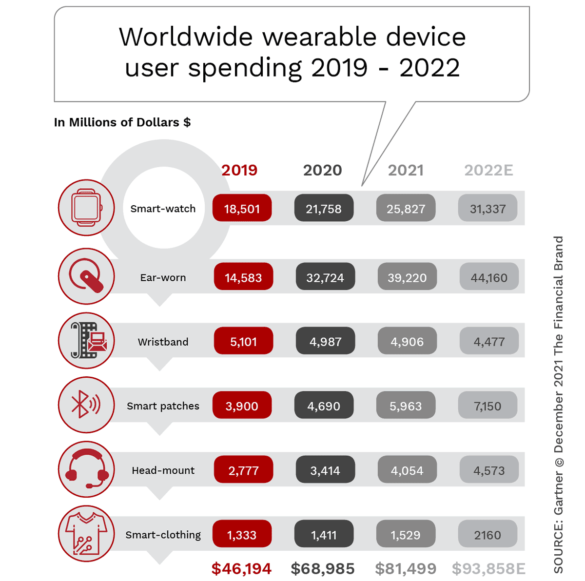

While consumer use of smartphones will be a very significant driver of mobile banking for years to come, financial institutions shouldn’t limit themselves to building only for this form function. To do so will set them up for potential disruption, as they hold on to ‘tradition’ without understanding shifts in consumer experience preferences. Remember, many people never saw themselves wearing a watch again after smartphones became popular, yet today smartwatches are one of the most significant growth categories.

Read More:

- Digital Banking Transformation to Focus on Channels & Analytics

- Executing What’s Possible With Digital Banking Transformation

- The 6-Step Survival Guide to Digital Banking Transformation

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Making Embedded Finance Invisible

When we discuss embedded finance, we often refer to the ability for banking to become an integral part of a customer’s life, positioning finance at the center of a product ecosystem that expands beyond traditional deposits, loans and investments into payments, shopping, social engagement, etc. According to Ben Brown from Accenture, “Embedded finance is all about the contextual offering of financial services in a way that’s relevant to consumers and with an understanding of what their needs are.”

The intended benefit of embedded finance is convenience – not requiring the use of multiple apps to accomplish tasks, similar to how Uber processes all components of a ride sharing experience. But why should embedded finance be limited to products as opposed to the entire experience?

When reimagining mobile communication technologies, retail banking leaders need to rethink how a consumer prefers to interact in daily life and the power that locational tracking of people can have on the overall experience. They also need to realize the benefits of making the actual device more invisible while making the power of where a person is and what they want to accomplish more visible. Because of the potential ethical and societal impacts of locational tracking, financial institutions also must increase their focus on value transfer to the customer for use of their personal data.

Immersive AR Engagement Beyond Goggles

Most people have tried or are aware of early virtual reality (VR) glasses that only show a digital landscape, and augmented reality (AR) glasses that mix information like text or images into a view of the real world in real-time. There are also examples of AR appearing on smartphones, where information or visuals are superimposed on top of the device’s screen. For the most part, these experiences have been through rather bulky Goggles used by gamers or slightly more refined eyewear that cost several thousand dollars.

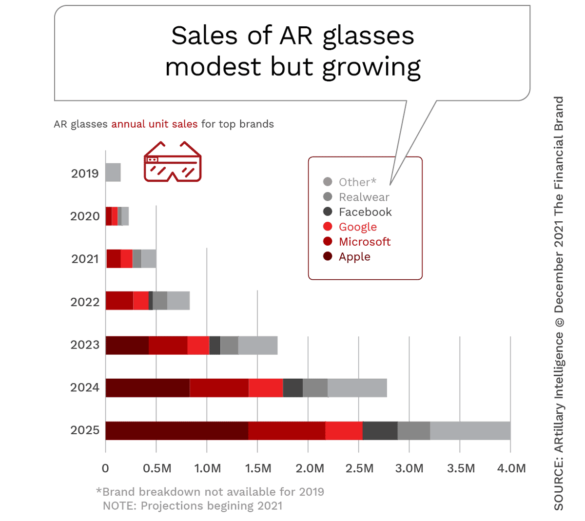

But, as big technology companies including Apple, Google, Facebook, Microsoft and others race to create a pair of fashionable smart glasses that will be embraced by consumers, how far away are we from the next way to do mobile banking? It depends on technology advances, which continue to move forward … quickly.

Hurdles Remain for AR Glasses:

“Smart glasses must become a comfortable, easy to use, socially acceptable form factor that people feel fits the way they want to express themselves.”

Advances in miniaturization are enabling device makers to integrate sensors into wearables that are nearly invisible to the end user. Gartner predicts that by 2024, miniaturizing capabilities will advance to the point that 10% of all wearable technologies will become unobtrusive to the user. Micro displays and optics in AR glasses are also improving quickly with better picture quality, lighter weight, longer battery life and less heat generation. Many current iterations come equipped with voice activated applications that are managed through a mobile phone.

Will Apple Win Where Others Have Struggled?

Offering consumer-friendly pricing. easy-to-use apps, libraries of content and broader use cases is the way to accelerate broad user adoption of smart eyewear. Obviously, there is also a need to ‘make it cool’ to wear AR or smart glasses. Who better to make this all happen than Apple?

There has been quite a bit of speculation recently that Apple is planning to introduce an AR headset or smart glasses in 2022 that will display information, objects and data on a headset or glasses. The scope of this introduction ranges from simply another way to access the internet, to being a gateway to the metaverse. Whatever the initial foray becomes, the potential for smart glasses to be the next iPhone can’t be ignored. Neither can dozens of recent patents granted to Apple on innovative eyewear technology.

While the marketplace for headsets and glasses is rather small currently, the growth is expected to be impressive, with Apple and Microsoft battling for dominance. According to several sources, any Apple headset would most likely use Apple’s new homemade chips, which are superior in terms of how much computing power a single battery charge can provide.

The ability to provide messages, social media interactions, driving directions and basic alerts on a heads-up display is only the beginning according to analysts. While early AR glasses may still lack broad functionality, remain bulky and be tethered to a mobile phone, we will most likely see glasses that are fashionable, light enough for prolonged use, and as capable as today’s smartphones within the decade.

Apple’s Future Tied to AR:

“Meta and Apple are betting big that smart glasses and HMDs are going to be the next personal computing paradigm. Smart glasses will completely reframe banking to be highly contextual and real-time, stripping away the banking products of old, to embedded real-time experiences.”

– Brett King, Author of The Rise of Technosocialism

Many are betting on Apple as the growth in demand for all smartphones slows. We already see the shift in Apple’s strategy to sell more accessories, like watches and audio devices. Supplementing this growth (and protecting their mobile user base) with smart glasses is logical. Another major advantage, according to an article by Christopher Mims from the Wall Street Journal is that Apple is “expert at creating hardware that inspires FOMO – an acronym for the “fear of missing out.” And it has a vast army of developers that create the software and services that drive that feeling.”

Initially, any AR glasses from Apple will most likely rely on a tether to an iPhone for processing, allowing it to have significantly less parts, weight and complexity. This also opens the door to a great deal more functionality at a substantially lower price.

Voice Banking a Needed Stepping Stone

Most early versions of AR glasses integrate cameras, microphones, speakers, and even a form of touchpad into the eyeglass. This allows for hands-free launching, although some basic touch capabilities on the side of the glasses can also operate the device similar to many earbuds today. The key is to leverage our human senses of sight, touch and sound to make the experience completely immersive while not distracting from daily activities.

The integration of voice interaction increases the importance for financial institutions to continue to develop improved voice banking capabilities. Bank of America has made significant leaps in learning around the ability to expand banking engagement through their virtual assistant Erica. Not only can Erica conduct basic functions like balance retrieval and transfer of funds, but is now able to conduct much more complex interactions and provide financial recommendations using voice engagement.

Even if the advancement of AR eyewear does not meet growth expectations, the importance of building a strong voice banking capability can’t be ignored as most consumers already use voice commands on their smartphones, in their homes and in their cars.

Why Should Bankers Care About Smart Glasses?

It’s been well over a decade since the introduction of the iPhone, which combined a phone, a media player, and an ultra portable computer into a hand-held communications device. It changed businesses and society. Since then, most introductions by Apple and other competitors have been accessories as opposed to smartphone successors. Just as gamers helped to popularize early smartphones, they are also early adopters of VR and AR devices.

With the emergence of more powerful chips, more fashionable designs, 5G speed, and a vastly increasing array of developers and manufactures, it is no longer a matter of ‘if’, but ‘when’ for AR glasses. And with the speed of change being faster than ever, financial institutions must prepare for the ability to deliver banking across new devices.

As mentioned in a recent article in Fast Company, “As the smart glasses form factor becomes more Tom Ford and less Geordi La Forge, wearing them may feel no less unlikely than past longshot trends, such as people stuffing 6-inch rectangles in their pockets, wearing flashing squares of colorful light on their wrists, and walking around with little white antennae pointing down from their ears.”

Be forewarned and prepared.