When Chuck Bruen, the CEO of First Entertainment Credit Union, wrote in his blog that some credit unions are “too small to exist,” he touched off a sensitive debate among credit union leaders about what role — if any — America’s tiniest credit unions should play.

The failure of Convent FCU in New York City, the 11th credit union to be liquidated in 2010, sparked Bruen’s controversial suggestion.

“It is my opinion that there are credit unions that are too small to exist,” Bruen wrote.

How small is too small? “I don’t know,” Bruen continued. “But a credit union with 213 members and $175,000 certainly falls in that category.”

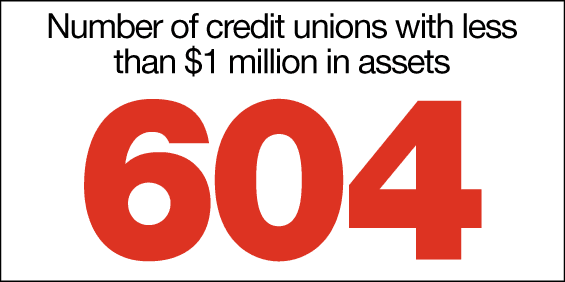

Bruen recommends shuttering any credit union less than $1 million, then raising the bar from there.

This suggestion triggered a reaction from Sarah Snell Cooke, Editor in Chief at the Credit Union Times, on the publication’s website. “Eliminating all credit unions under $1 million would destroy the only financial hope some people have beyond payday lenders and pawn shops,” she cautioned.

Even though Snell Cooke argues there’s a need for small, hyper-focused credit unions, she wonders about their viability. Regarding Convent FCU and its failure, she wrote, “I’m not sure how a credit union that size remains in business in the 21st Century.”

Another commenter named “Jerry” said he felt “the bottom limit for credit unions should probably be $3 million. Below that size, they are not economically viable. Within five years, that lower economic limit will probably be $5 million.”

Cliff Rosenthal, President/CEO of the National Federation of Community Development Credit Unions, thinks time will take care of these ultra-small credit unions, regardless of where one stands. “The gears of regulation and examination will slowly (or not so slowly) grind away many of those institutions whose death Mr. Bruen would like to hasten,” Rosenthal observed in the comments of the Credit Union Times blog post.

Rosenthal likened Bruen’s suggestion to euthanize small credit unions to “death panels.”

What do you think? Take the poll below and share your thoughts in the comments.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

[poll id=”24″]

All statistics calculated by The Financial Brand using 2010 data provided by Callahan & Associates (CreditUnions.com).

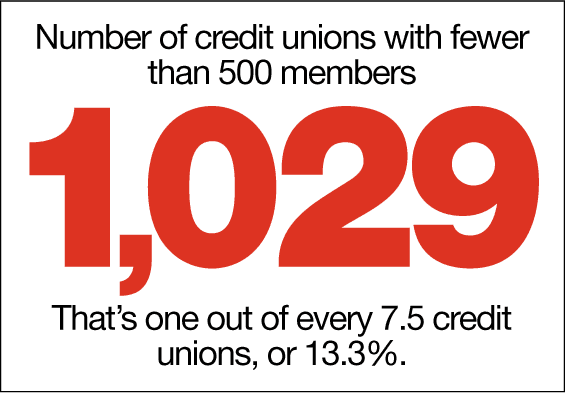

There are 1,029 credit unions with less than 500 members.

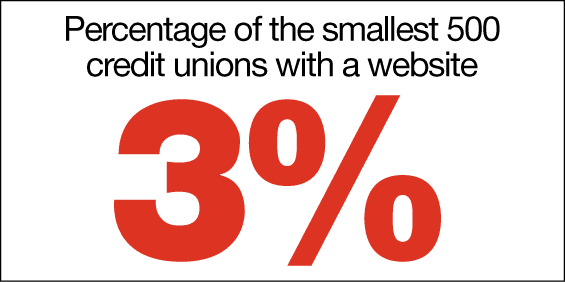

Only 15 of the 500 smallest credit unions have websites.

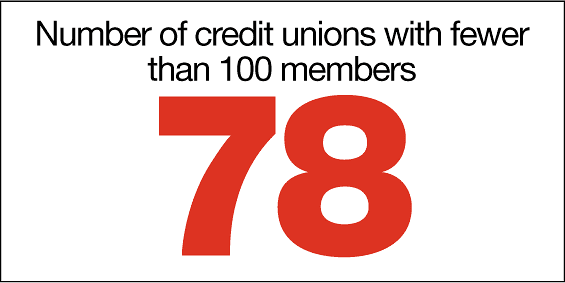

There are 78 credit unions with less than 100 members.

There are 15 credit unions with only one member.

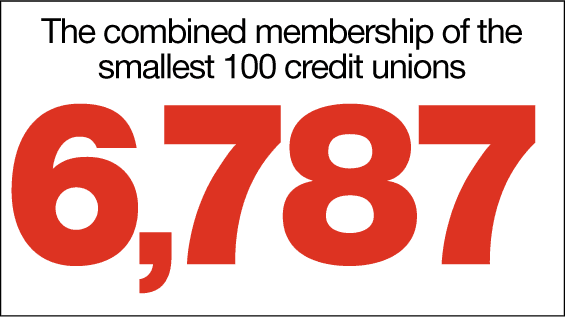

If you rank the smallest 100 credit unions by number of members, they serve a combined membership of 6,787.

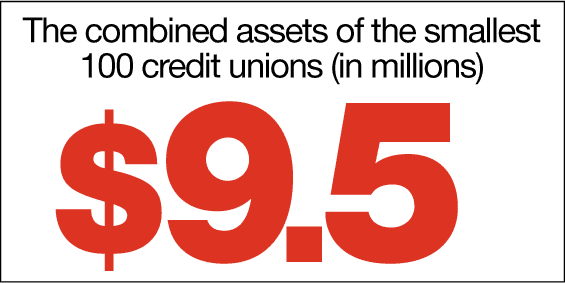

The 100 smallest credit unions by assets have only $9.54 million combined, and serve 16,485 members. There are 1,099 credit unions who each serve at least that many members.

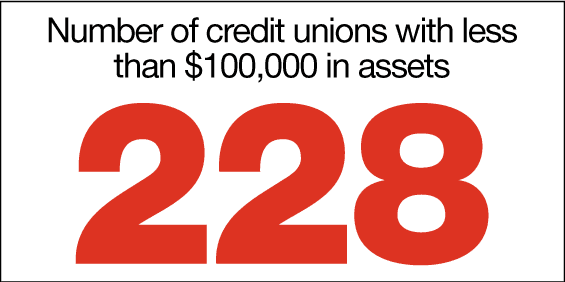

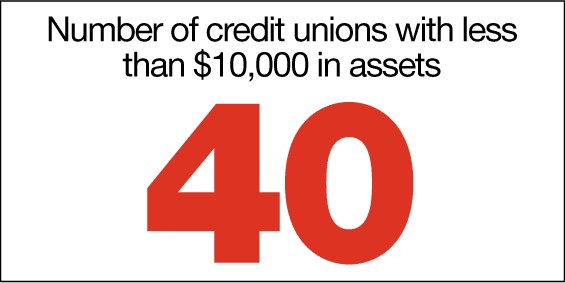

228 credit unions have less than $100,000 in assets. 40 have less than $10,000.

There are 640 credit unions with less than $1 million in assets, for a combined total of $304 million.

Conversely, the 596 largest credit unions each have over $300 million in assets.