The Financial Brand sat down with Rob Garcia, Senior Director/Product Strategy at Lending Club, to talk about why and how the popular peer-to-peer lending service redesigned its brand identity. You can follow along with Rob’s thoughts on the Lending Club blog, or connect with Rob on LinkedIn and Twitter. Enjoy the interview.

The Financial Brand (TFB): Why change the brand identity? What were you looking to achieve?

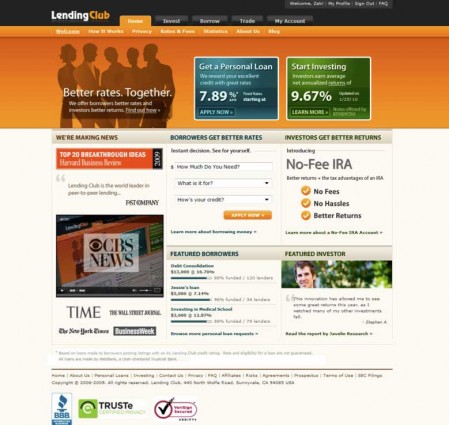

R ob Garcia (pictured left): There was nothing particularly wrong with the old look. The old Orange-Black scheme helped us get through the noise and stand out. It was clearly different from everything else available in the financial services space three years ago when we launched. As Lending Club made itself known and is now a more recognized financial brand, our original color palette and brand identity started to feel outdated and not reflect the company’s and product evolutions.

ob Garcia (pictured left): There was nothing particularly wrong with the old look. The old Orange-Black scheme helped us get through the noise and stand out. It was clearly different from everything else available in the financial services space three years ago when we launched. As Lending Club made itself known and is now a more recognized financial brand, our original color palette and brand identity started to feel outdated and not reflect the company’s and product evolutions.

Our new look better expresses our values (trustworthy, transparent, professional yet friendly and accessible) as well as Lending Club’s commitment to innovative financial services.

OLD WEBSITE

NEW WEBSITE

TFB: Does the new logo mean anything?

RG: That’s a very interesting question. The logo does not signify anything in particular, but it does have several interpretations that we like. That’s the beauty of this logo.

Its simplicity and typography make you feel safe, but then you find yourself wanting to interpret the logo. Everyone thinks of it differently, and I’ve heard at least 15 different interpretations. The one I hear the most is when people see themselves as the missing square. Other people see it as the missing piece in the banking industry. Some see a loan, and each square is a contribution to the loan — a note or investment. Others see is a break into a solid industry where people could not participate directly in the past.

What’s your interpretation?

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Fractional Marketing for Financial Brands

Services that scale with you.

TFB: It looks like the single red square dotting the “I” is “an individual” looking to connect with “a community” of other like-minded red squares. The individual could be either an investor or a borrower. But this sort of rationalization and interpretation can start to sound like marketing baloney real fast.

RG: You should share that with the audience. It would be fun.

TFB: Are there any new features added to the website coinciding with the image enhancement/upgrade?

Our concept is smart and simple, and our new site is now simpler, more concise, and clearer. Our goal is to make it easier and more engaging for our members to get lower rates and earn better returns. The new site works harder to help investors better understand our concept, and the most creditworthy borrowers now feel more confident in getting a loan at better terms than they would get from a traditional bank.

TFB: What kind of feedback were you getting from users? How did this shape the redesign?

RG: One thing we don’t lack is input from our members. We have a very vocal community that we enjoy working closely with. I’m practically everywhere and available to our customers via email, phone, Twitter, Facebook, etc. For this particular redesign, we conducted member interviews, focus groups and usability testing of several directions.

The perception of the old brand was consistent: cutting edge, innovative, different, but also non-established (too new), unsecured, complex. We worked hard to find the new face of Lending Club that kept the essence of our innovative financial concept, but better expressed our transparency, professionalism, security, and trustworthiness. The trick was in achieving all that without looking like an old bank or financial institution. Instead we wanted to continue reflecting what our users like about Lending Club: approachable, simple, no non-sense, no hidden agenda (or fees), etc.

TFB: Did you partner with a web company or go it alone?

RG: I led the internal team, and we partnered with Mule Redesign. From day one, the two teams connected and became one. It was truly a joy to work with a group of very talented designers and strategists — on both sides.

We also had Pam Kramer, eTrade’s ex-CMO, as our advisor throughout the project.

A key component of the redesign was hiring the right team. I’m a firm believer in bringing in a brilliant external team with expertise not only on brand/web redesign but also industry specific experience.

TFB: How long did it take to redesign and launch the website?

RG: The last version of the site was three years old. Although it went through a few iterations and evolutions, the core design principles where the same. The project took no more than five months from ideation to final release.

TFB: How long before the next redesign?

RG: I really think the new brand has potential to last a long time. It has a timeless quality to it that’s part of its ingenious design. The next thing for us is to focus on usability and fine tuning the site as well as extending the brand beyond the site and collateral. We’re also spending more time looking into features and functionality that would make investing and taking a loan even simpler.

Stats & Facts: Lending Club at a Glance

Founded in 2006 and officially launched in 2007. At the time, it was the first financial application on Facebook. The company grew quickly, issuing $3,000,000 in loans within the first three months of operations. After registering with the SEC in 2008, Lending Club introduced its previous black/orange brand and website. In February 2010, Lending Club passed $1 billion in total loan requests and expects to issue $100 million of loans in March. Growth averages 5-10% Loan origination volume grows around 5-10% monthly. Investors have consistently made over 9.5% net annualized returns since 2008.